De Minimis: A Vital Tax Exemption

The NFTC is committed to supporting policies that help U.S.-based businesses reach consumers, navigate complex supply chains and manage rising costs in the global economy. That’s why we are working to ensure that the thousands of American small businesses that use a vital, Congressionally supported tax exemption knows as de minimis can maintain access to it.

What is the De Minimis Tax Exemption?

The De Minimis Tax Exemption is a law that Congress passed on a bipartisan basis that allows shipments bound for American businesses and consumers valued under $800 (per person, per day) to enter the U.S. free of duty and taxes.

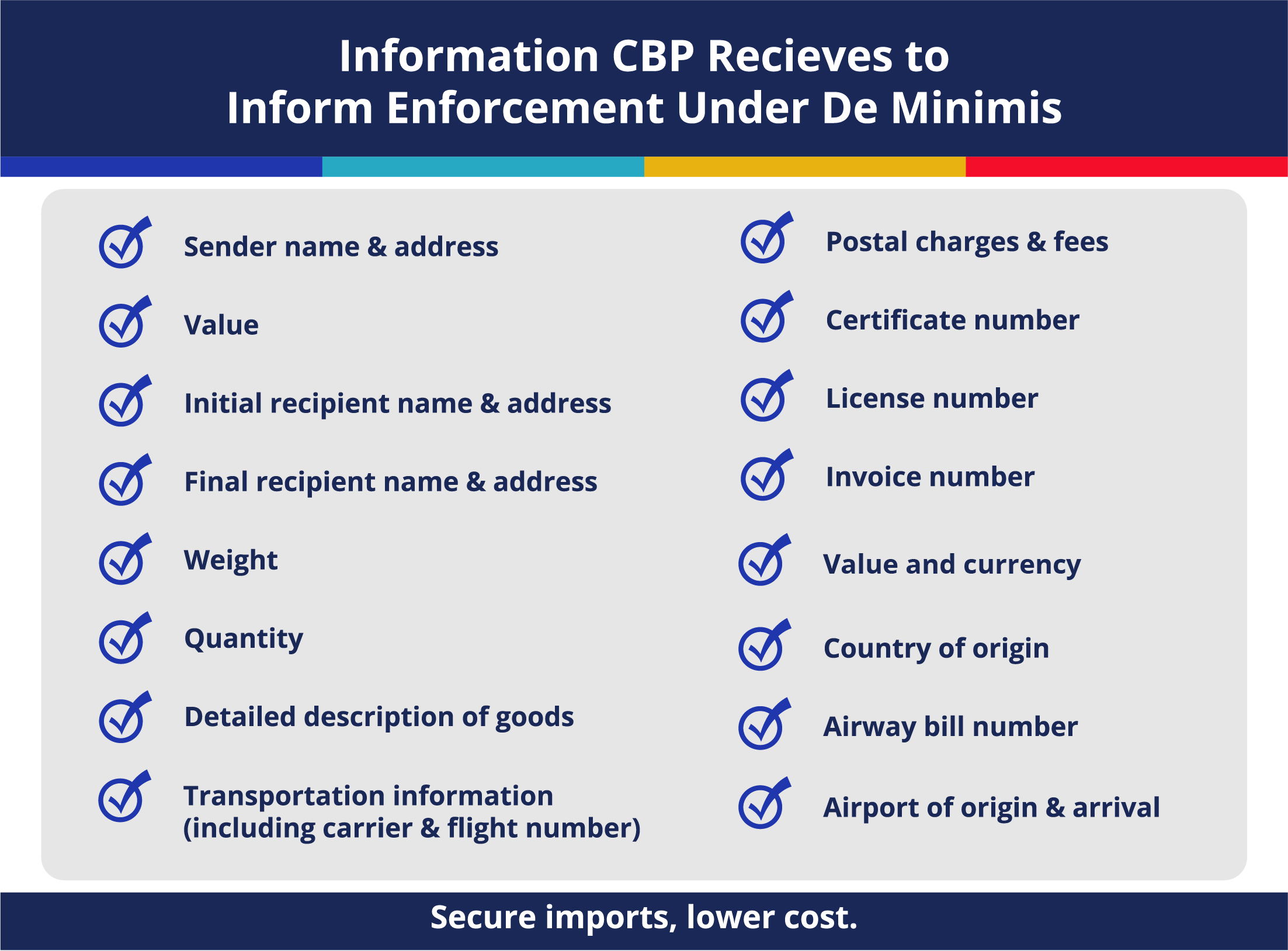

While the tax exemption allows for tax-free treatment, U.S. Customs and Border Protection (CBP) screens these low-value shipments just as they would screen higher-value entries coming through other modes. These shipments are subject to screening and review by over fifty federal agencies enforcing over 500 U.S. laws.

Why did Congress Pass the De Minimis Tax Exemption?

IT REDUCES INFLATIONARY PRESSURE AND SUPPLY CHAIN DELAYS:

The de minimis tax exemption allows goods to be shipped quickly and affordably – benefits every American gained an appreciation for during the pandemic. At a time when our nation’s small businesses are continuing to shoulder the pressures of inflation and a slowly recovering supply chain, they cannot afford to be burdened again through the elimination or reduction of the de minimis tax exemption. The last thing lawmakers should be considering coming out of the pandemic is to raise taxes and increase red tape for small businesses.

IT ALLOWS CBP TO CONCENTRATE LIMITED RESOURCES WHERE THEY MAKE THE MOST IMPACT:

Removing de minimis would shift the CPB’s focus away from the border, where a vast majority of illegal substances and products are entering the country. CBP would need to hire and train new personnel, costing the agency millions or causing them to move agents from the already overburdened southern border.

Who Benefits from the De Minimis Tax Exemption?

AMERICAN SMALL BUSINESSES AND CONSUMERS:

Particularly as more small businesses in America rely on e-commerce to launch and grow, the de minimis tax exemption provides access to inputs for small businesses seeking to sell their products at home and across the globe. The savings these businesses get through the tax exemption are passed on to consumers and allow businesses to hire and expand.

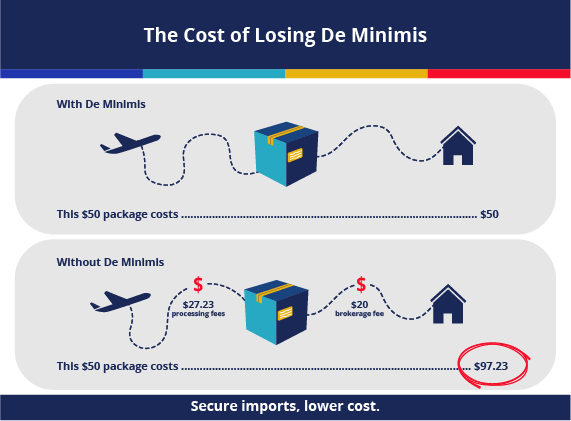

“For instance, consider a typical consumer or small business buying an imported good for $50 on an e-commerce platform in the absence of de minimis trade. … That $50 purchase is nearly doubled to $97, even before adding on tariffs. In other words, getting rid of the de minimis threshold could translate to an additional $47 billion in costs for consumers and business owners annually.” – Christine McDaniel, Senior Research Fellow at the Mercatus Center at George Mason University, via Forbes

LOW-INCOME AND UNDERSERVED COMMUNITIES:

If you live in a community without nearby access to retail stores, the de minimis tax exemption provides essential access to affordable goods. According to the Centre for Economic Policy Research, the tax exemption disproportionately benefits low-income households and African American and Hispanic families. De minimis allows items like television cables, phone chargers, picture frames, batteries, beauty supplies and more to be delivered promptly to Americans no matter where they live.

Resources

VOICES ROUNDUP: Why De Minimis Matters to the American Economy

Businesses across America, large and small, are voicing their support for de minimis. Read below about how de minimis is a lifeline for American businesses and their plea to Congress to keep this critical trade policy in place.

What They're Saying

Peterson Institute for International Economics

"De minimis gives a leg up to two groups of Americans who are too often overlooked in trade policy: consumers and small businesses. Thanks to the internet and de minimis, consumers can order from distant suppliers with the click of a mouse, while small business firms can find just the right input at a competitive price."Gary Clyde Hufbauer (PIIE) and Megan Hogan (PIIE)

CBP Trade Policy Director: de Minimis Is No Loophole

"There's a misconception that we don't target or screen de minimis -- it's not true. People throw around the phrase 'loophole.' It's not a loophole. De minimis is not a loophole."Brandon Lord, Executive Director of the Trade Policy and Programs Directorate, via International Trade Today

DHS Undersecretary: Forced labor law does apply to de minimis shipments

"To be clear, the UFLPA does apply to de minimis shipments. We conduct our risk-based targeting and other approaches on de minimis shipments. However, there are challenges."Robert Silvers, DHS Undersecretary for Strategy, Policy and Plans

Christine McDaniel: Eliminating de minimis trade altogether could be prohibitively expensive.

"Eliminating de minimis trade altogether could be prohibitively expensive. It would mean dumping nearly a billion parcels into America’s mainstream port system, which is often characterized as fragile and ranks poorly, lagging behind the more automated and efficient ports of our trading partners. This would raise costs for businesses and consumers alike."Christine McDaniel. Senior Research Fellow at the Mercatus Center at George Mason University via Forbes

De Minimis in the News

The Ironton Tribune Letter to the Editor: Proposals would harm small business

From Inside U.S. Trade: NFTC: De minimis system can be strengthened without excluding China

From POLITICO Morning Trade: DHS: De minimis not a customs loophole

Christine McDaniel Oped in Forbes: Solving The Big Problems That Come In Small Parcels

Miami Herald Letter to the Editor: Trade Bill Hurts

From International Trade Today: CBP Trade Policy Director: de Minimis Is No Loophole